The software allows you to set reminders for upcoming payments, analyse incomings and outgoings with charts or graphs, and set short- and long-term budgets. This can be a powerful tool if, for example, you want to see how long it will take to save up for a car, or where you could cut back on spending.

/business-woman-thinking-account-989484872-d5ffd42eacac4a8598a631ac6c59a28f.jpg)

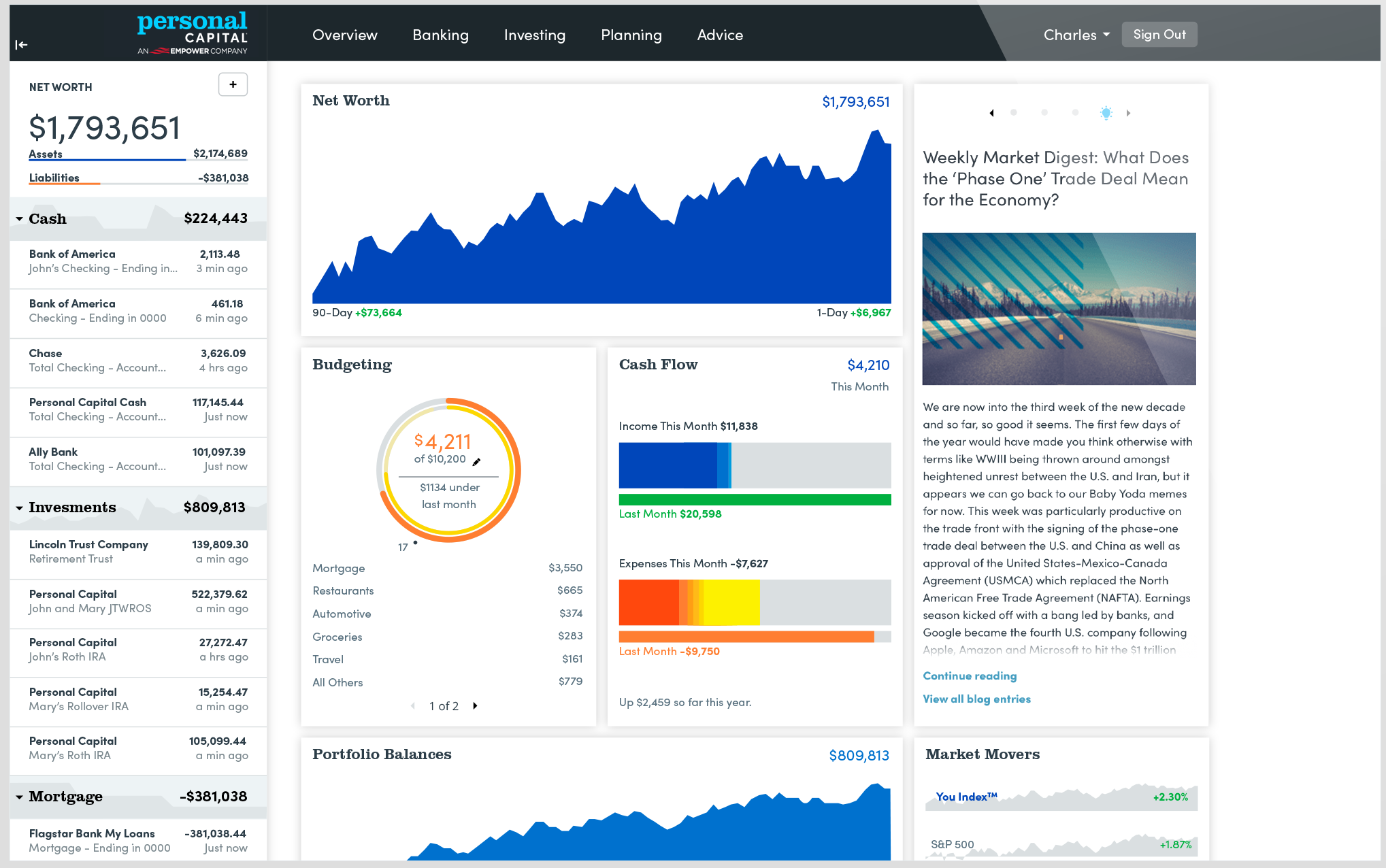

Personal finance software allows you to see where your money is going on a monthly or yearly basis, and use this information to set goals. If you're not already a member, join Which? and get full access to these results and all our reviews. Which? members can log in to see the full results in the table below. Our table below shows how these complex tools were rated on features that are important to you, including overall performance, customer support and the mobile app. In our latest tests, we awarded three Best Buys, while one of the packages was very close to being awarded a Don’t Buy. We tested nine of the leading personal finance software packages available to UK users - You Need A Budget, Moneydance, AceMoney, Buxfer, Banktivity, BankTree, Home Accountz, GnuCash and HomeBank. While some packages are free to use, some will charge you anywhere up to £60 a year. Which? members can log in to see the full results in the table below. If you're not already a member, join Which? and get full access to these results and all our reviews. We put nine personal finance software packages to the test, to find out which are best at helping you manage your money. The programmes allow you to monitor your bank accounts, credit cards, loans and investment balances in one place, as well as log your income and outgoings – giving you an in-depth picture of your position and helping you set goals for the future.

Personal finance software helps you keep track of your money and make smarter financial choices.

0 kommentar(er)

0 kommentar(er)